Is Acorns worth it? With Acorns, you can automatically save & invest your spare change from everyday purchases, earn Found Money with 300+ brands, read custom content to grow your knowledge and put your hard-earned cash into diversified portfolios overseen by experts.

Acorns is a micro-savings app similar to Digit and Qapital, but with a kick. This app saves you money but allows you to invest this money with a click of a button.

Your savings can actually make you money, and you can even get started with a $20 bonus through this link.

In this Acorns review, we will answer the question: Is Acorns worth it?

| Update: Acorns is now offering a $20 sign up bonus for newly opened accounts. After registering, you'll see the $20 balance in your account. |

Acorns at a Glance

What we liked about Acorns

|

What we didn't like about Acorns

|

Best for: If you're a college student you can sign up for Acorns with your .edu email address and use it for free. Or for individuals new to investing, especially those who prefer a hands-off approach. It's ideal for people who want to start with small amounts of money, such as spare change from everyday purchases, and gradually build their investment portfolio without needing extensive financial knowledge. Busy professionals, students, and anyone looking to automate their savings and investments will find Acorns particularly beneficial.

The bottom line on Acorns: It's a great tool for beginners and those who want to invest small amounts automatically. With its ease of use and automated features, Acorns simplifies the investment process, making it accessible and convenient for everyone.

What is Acorns?

|

Featured App: Acorns LEARN MORE |

About Acorns:

|

CNBC calls it “the new millennial investing strategy.”

Once you connect the app to a debit or credit card, it rounds up your purchases to the nearest dollar and funnels your digital change into an investment account.

Sign up to try it risk-free with a $20 sign up bonus.

Acorns in Action

Acorns Features

One feature that we love about Acorns is that the money that you're saving is being invested. By investing your spare change, it makes it simple for you to grow wealth over time.

So what's the big deal about investing?

Well, do your coworkers or friends all talk about their investment portfolios? You’ve been meaning to get in the stock game, but how do you start if you don’t have a big wad of cash to invest?

We’ve got your answer. It’s called Acorns, and it’s an app that lets you start investing without risking big bucks.

Acorns offers the following:

1. Round-Ups: Acorns' most popular feature, Round-Ups, automatically invests your spare change from everyday purchases. By linking your credit or debit card, Acorns rounds up each transaction to the nearest dollar and invests the difference. This micro-investing approach is great for beginners, making it easy to start investing without significant initial capital.

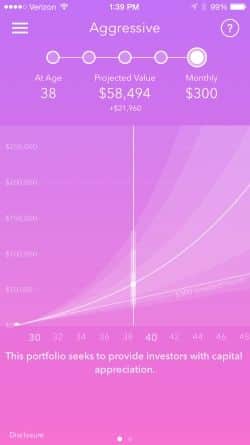

2. Diversified Portfolios: Acorns offers diversified portfolios based on Modern Portfolio Theory, designed by experts to match various risk levels. Users can choose from conservative to aggressive portfolios, ensuring that there’s an option suitable for different investment goals and risk tolerances.

3. Recurring Investments: For those who want to grow their investments more quickly, Acorns allows users to set up recurring daily, weekly, or monthly deposits. This feature encourages consistent investing, helping users build their portfolios over time.

4. Retirement Accounts (Acorns Later): Acorns Later offers IRA options, including Traditional, Roth, and SEP IRAs. This feature is designed for long-term savings and is an excellent option for those looking to save for retirement with minimal effort.

5. Found Money: Found Money is Acorns’ cashback feature, where users can earn bonus investments when they shop with Acorns' partner brands. This feature adds an extra incentive to shop through the app, contributing to your investment account as you spend.

6. Educational Content: Acorns provides a wealth of educational content aimed at improving financial literacy. The articles and videos cover a wide range of topics, from basic investing principles to more advanced financial strategies. This is particularly beneficial for beginners looking to expand their financial knowledge.

7. Acorns Early: Acorns Early allows users to open investment accounts for their children. This feature is designed to help parents save for their kids' future, giving them a financial head start.

8. Fees: While Acorns offers many convenient features, it's important to consider the cost. The service charges a monthly fee ranging from $3 to $9, depending on the plan. For users with small balances, these fees can be relatively high compared to the amount invested, which might erode some returns.

Bottom Line:

Acorns' features are well-suited for beginners and those who prefer automated, hands-off investing. Its micro-investing approach, educational content, and additional savings tools make it an attractive option. However, potential users should weigh the convenience against the cost, especially if they have smaller account balances.

How Does Acorns Work?

Acorns works by linking your credit or debit cards to the app, tracking your purchases, and rounding up each transaction to the nearest dollar. The spare change from these Round-Ups is automatically invested into a diversified portfolio that matches your risk tolerance. You can also set up recurring investments to deposit fixed amounts regularly.

Additionally, Acorns offers Found Money, a cashback feature from partner brands, and retirement accounts through Acorns Later.

For parents, Acorns Early allows investment accounts for children. Overall, Acorns makes investing easy and automatic, ideal for beginners and those seeking a hands-off approach.

Check out this video for more about how Acorns works.

How Does Acorns Protect Your Information?

All of your data is protected with 256-bit encryption and never stored on your phone, tablet or computer.

You can learn about Acorn's security measures here.

Acorns Fees and Pricing

Acorns, a robo-advisor app, has three account management fee tiers, ranging from $3–$9 per month:

- Personal: $3 per month

- Personal Plus: $6 per month

- Premium: $12 per month.

For more, check out the pricing page.

The Personal plan includes a checking account, investment account, and retirement account.

The Personal Plus plan includes all the features of the Personal plan, plus Premium Education, Emergency Fund, and Earn Rewards Match.

The Premium plan includes all the features of the Personal and Personal Plus plans, plus Benefits Hub, Custom Portfolio, Earn Rewards Match and Early, and Acorns' UTMA/UGMA investment accounts.

Acorns Alternatives

If you don't think Acorns is worth it, you can check out apps like Acorns and alternatives.

8/10 Qapital Review |

Gabcast Rating: Gabcast Rating:8.6/10 Digit Review |

9/10 Acorns Review |

| OPEN ACCOUNT | OPEN ACCOUNT |

OPEN ACCOUNT |

| Devices iOS App, Android App |

Devices iOS App, Apple Watch, Android App, SMS |

Devices iOS App, Apple Watch, Android App |

| Promotion $10 Sign up Bonus |

Promotion $5 Sign up Bonus |

Promotion $20 Sign up Bonus |

| COMPARE THE MICROSAVINGS SERVICES |

Is Acorns Worth It?

To conclude our Acorns review, we are left with the following question: Is Acorns worth it?

Acorns is worth it for anyone looking to start investing with minimal effort and financial knowledge. Its micro-investing feature, which rounds up your everyday purchases and invests the spare change, makes it incredibly easy to grow your savings without feeling the pinch.

With diversified portfolios designed by experts, recurring investment options, and additional features like Found Money and retirement accounts, Acorns offers a comprehensive and user-friendly platform.

The educational content further empowers users to make informed financial decisions. Despite the small fees, the convenience and simplicity Acorns provides make it a valuable tool for beginners and busy individuals aiming to build their financial future.

Overall, Acorns is a pretty well-laid-out investing app that helps you save small amounts of money with spare change and small daily investments as low as $5 a day or a week.

Imagine if you could invest in your future without really noticing it. Sign up in under 5 minutes and join over 8,200,000 people who thought Acorns was worth it.